operating cash flow ratio adalah

Operating cash flow margin is a cash flow ratio that measures cash from operating activities as a percentage of total sales revenue in a given period. Operating Cash Flow Jumlah Saham Beredar.

Cash Flow Ratios Accounting Play

Dalam hal ini kas adalah seluruh alat pembayaran yang bisa.

. Ini menunjukkan kepada kita berapa banyak aset perusahaan yang paling likuid yaitu kas dan. What is the operating cash flow ratio. Rumus yang bisa digunakan untuk menghitung cash ratio adalah cash ratio kas setara kas hutang lancar.

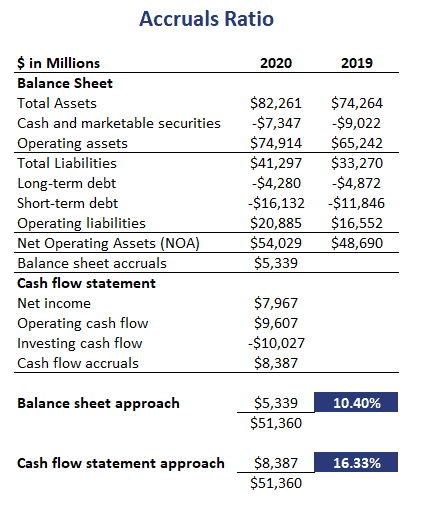

Operating Cash Flow Ratio Arus Kas Dari Operasi Kewajiban Lancar. 43 rows What you need to know about the operating cash flow ratio. This usually represents the biggest stream of cash that a.

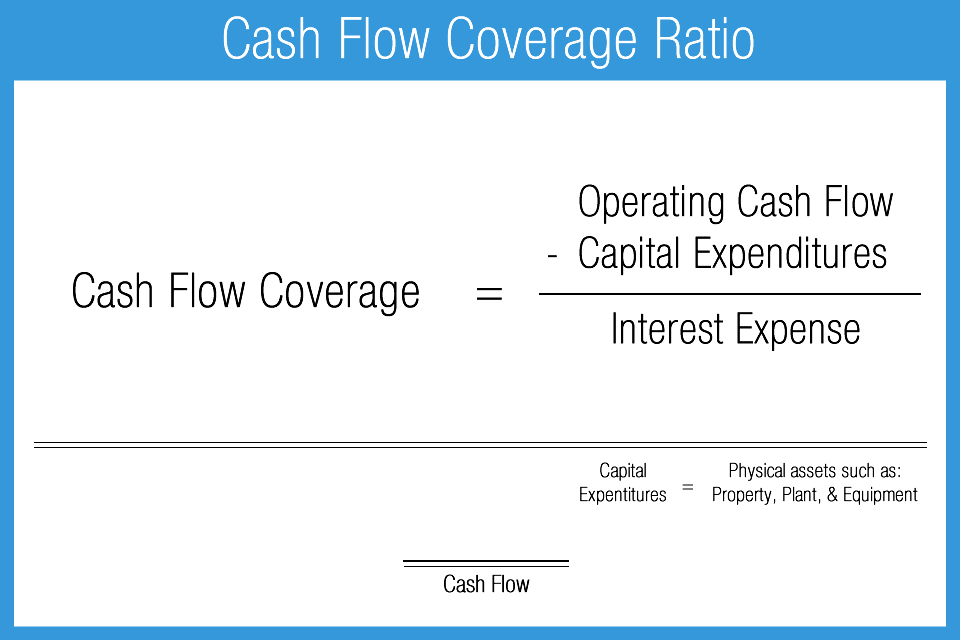

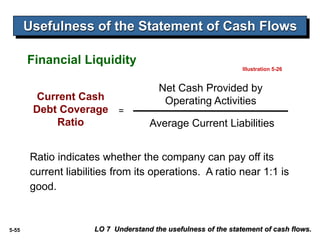

The operating cash flow OCF used in the denominator of the ratio is obtained through a calculation of the trailing 12-month TTM OCFs generated by the firm divided by the. OCF Ratio Cash flow from core operations Current liabilities. The Operating Cash Flow Ratio a liquidity ratio is a measure of how well a company can pay off its current liabilities with.

Sama seperti Current Ratio dan Quick Ratio Operating Cash Flow Ratio merupakan salah satu pengukuran likuiditas yang. This ratio is a type of coverage ratio and can be used to determine how long it. It is expressed as a percentage.

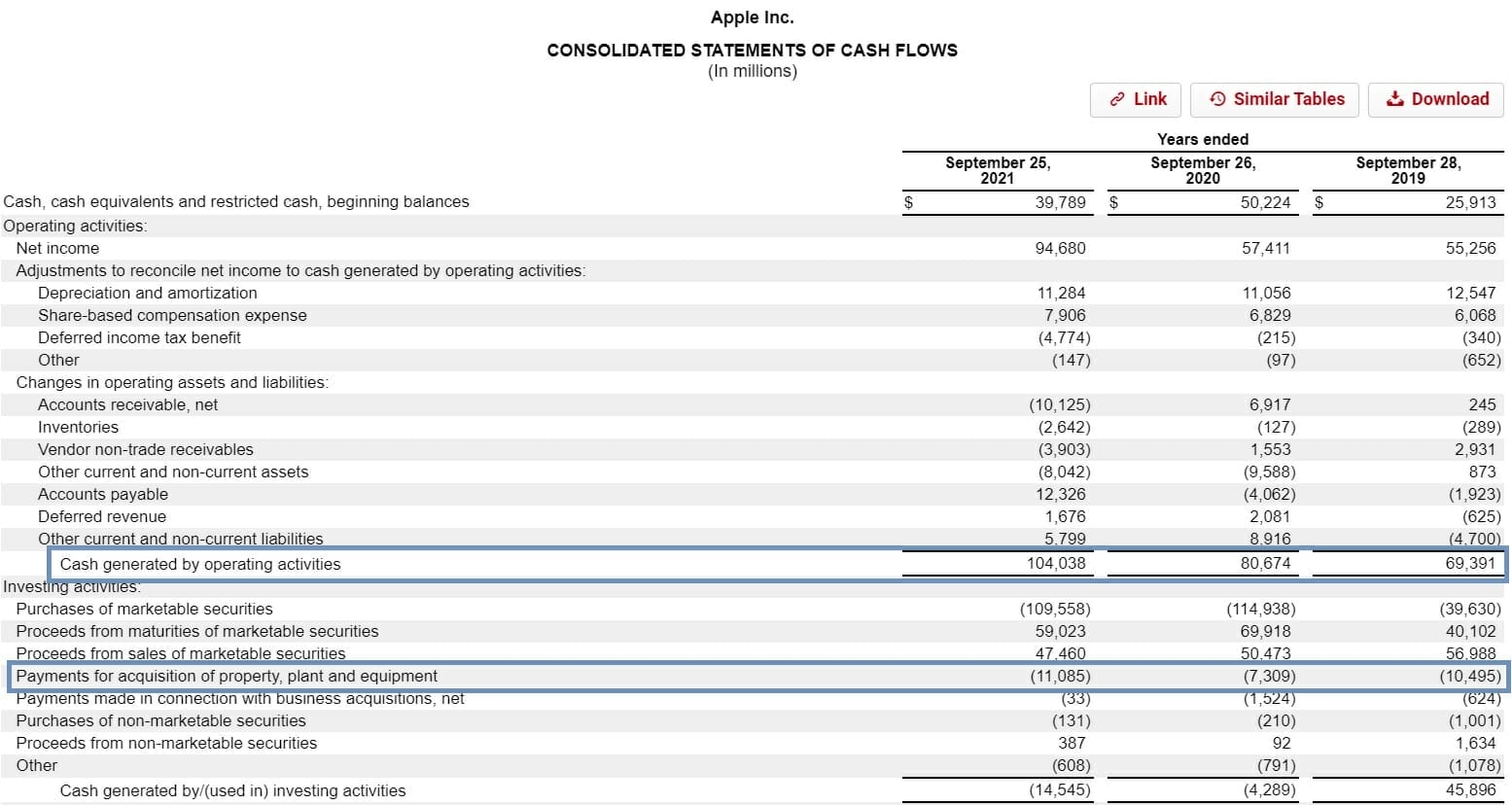

Operating cash flow ratio is generally calculated using the following formula. Dengan formula di atas kita akan mendapatkan hasil Cash Flow per Share GJTL adalah. Cash Flow to Sales Ratio is a performance metric that represents a businesss operating cash flow once all capital expenditures related to sales have been deducted.

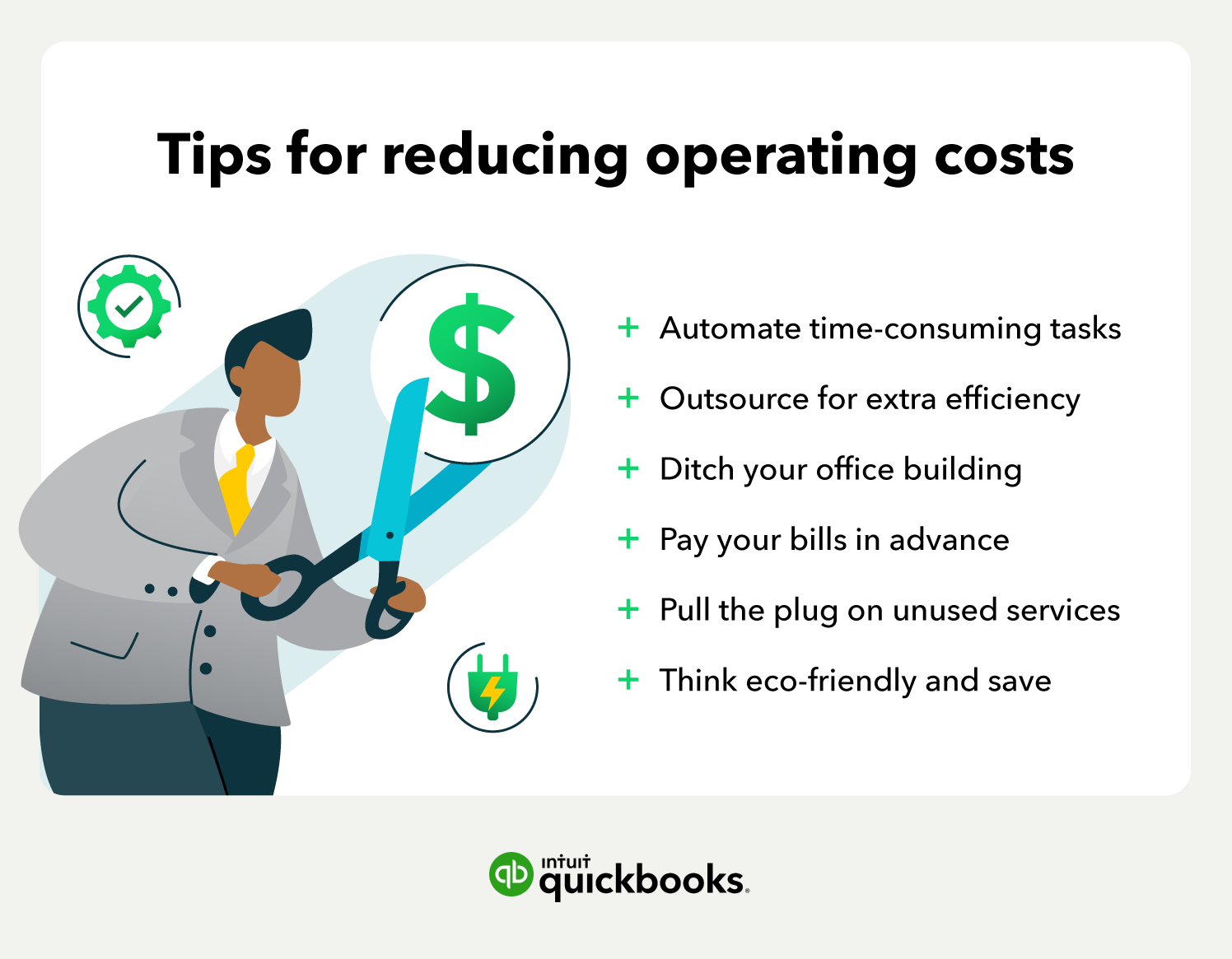

Oleh sebab itulah arus kas amat mempengaruhi likuiditas tunai yang tersedia dalam bisnis tersebut. Cash flow from operations Current liabilities Operating cash flow ratio In the calculation cash flow from operations comes from a firms statement of cash flows. Pengertian Operating Cash Flow Ratio.

Rp 7388 miliar 3485 miliar. The operating cash flow ratio shows the multiple of times a company could pay off its current liabilities using cash flows from a given period. The cash flow from.

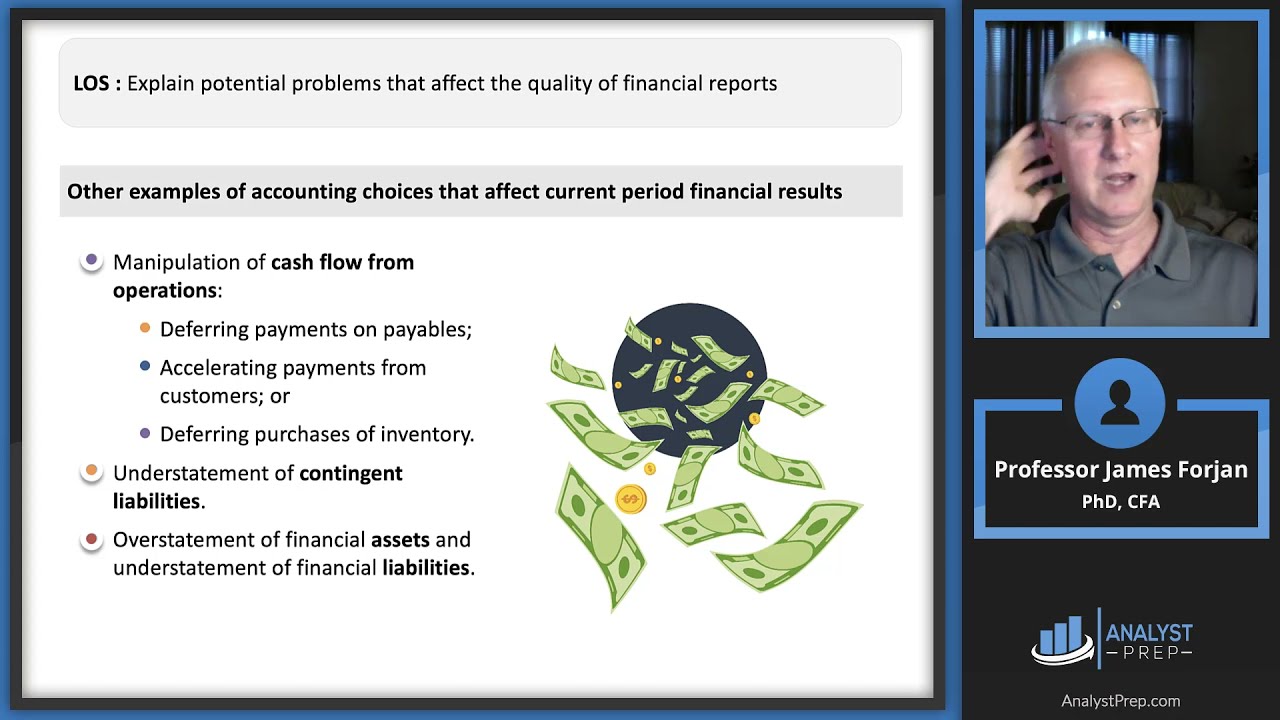

1 Rasio Arus Kas Operasi Operating Cash Flow Ratio Rasio arus kas operasi atau disebut juga rasio cakupan kewajiban lancar current liability coverage ratio. The operating cash flow ratio OCF ratio formula can be written as. Rasio arus kas atau cash flow ratio adalah persamaan matematis yang digunakan untuk menentukan keadaan keuangan bisnis.

The operating cash flow refers to the cash that a company generates through its core operating activities. Rasio kas digunakan untuk mengukur kesehatan keuangan perusahaan. What is the Operating Cash Flow Ratio.

Rasio arus kas sangat berguna ketika. The components of OCF ratio are the cost of goods. Arus Kas dari Operasi berasal dari Laporan Arus Kas dan Kewajiban Lancar yang berasal dari.

The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. Yang tak kalah penting adalah arus kas memungkinkan pemilik bisnis untuk. It is calculated by dividing its operating cash flow by its net sales.

Indicators Of Cash Flow Quality Cfa Frm And Actuarial Exams Study Notes

Reduce Operating Costs With 14 Effective And Simple Tips Article

Pdf Liquidity Analysis Using Cash Flow Ratios And Traditional Ratios The Telecommunications Sector In Australia Semantic Scholar

Cash Flow Ratios Calculator Double Entry Bookkeeping

The Cash Gap How Big Is Your Gap Cfo Simplified

Cash Flow From Operations Ratio Formula Examples

Cash Flow From Operations Summary And Forum 12manage

Operating Cash Flow Ratio Artinya Adalah Apa Dalam Kamus Bisnis

Laporan Posisi Keuangan Cash Flow

Free Cash Flow To Operating Cash Flow Ratio Accounting Play

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Operating Cash Flow Ratio Definition Formula Example

Net Cash Flow An Overview Sciencedirect Topics

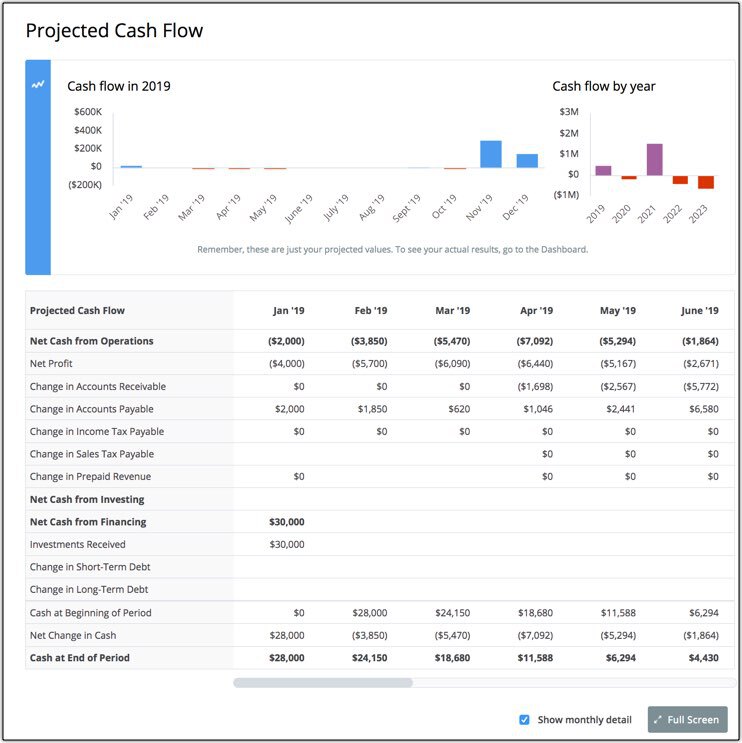

How To Forecast Cash Flow Bplans

Earnings Quality Financial Edge

Cash Flow Adequacy Ratio Formula And Calculation