installment open end credit example

Examples of open-end credit include home equity lines of credit department store credit cards service station credit cards and bank-issued credit cards. Some examples of open-end credit loans are credit cards home equity lines of credit HELOC and a personal line of credit.

What Is Revolving Credit Examples Score Impact More

An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date.

. Credit cards and credit lines are examples of revolving credit. An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving. An open-ended loan example is your credit card.

Access to credit allows consumers to make purchases today and then pay for them. Periodic payments are made until the loan is. A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment.

Common examples of open-end credit are. An open ended credit is something like a pre-approved loan where you can use the credit repeatedly over time. Open End Credit This is a type of credit loan paid on installments in which the total amount borrowed may change over time and is fixed.

Open End Credit This is a type of credit loan paid on installments in which the total amount borrowed may. CREDIT TYPE 1. A loan can be closed-end or open-end.

A good example of an open-end credit is A. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and.

An example of an installment loan would be a car loan you are required to pay a set amount of money at a recurring interval ex. Consumer credit is money that consumers can borrow to pay for goods or services. Credit cards are the.

Unlike closed-end credit an open-end credit can be used for your frequent and unexpected financial needs and not necessarily for a specific purpose. Installment credit is when you borrow a specific amount of money from a lender and agree to pay off the loan in regular. With some forms of open-end credit theres no end.

Examples of installment loans include mortgages auto loans student loans and personal loans.

What Is An Installment Loan Installment Loan Guide Security Finance

What Are Three Types Of Consumer Credit

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

Credit The Four Most Common Forms Christian Credit Counselors

Revolving Credit Vs Installment Credit What S The Difference Cash 1 Blog News

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

Definitions Of Consumer Credit Retail Credit Cash Credit

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Open End Credit Vs Closed End Credit Lantern By Sofi

3 Ways To Calculate An Installment Loan Payment Wikihow

Ch 7ba218 Personalfinance Flashcards Quizlet

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Section 11 4 Installment Buying Ppt Download

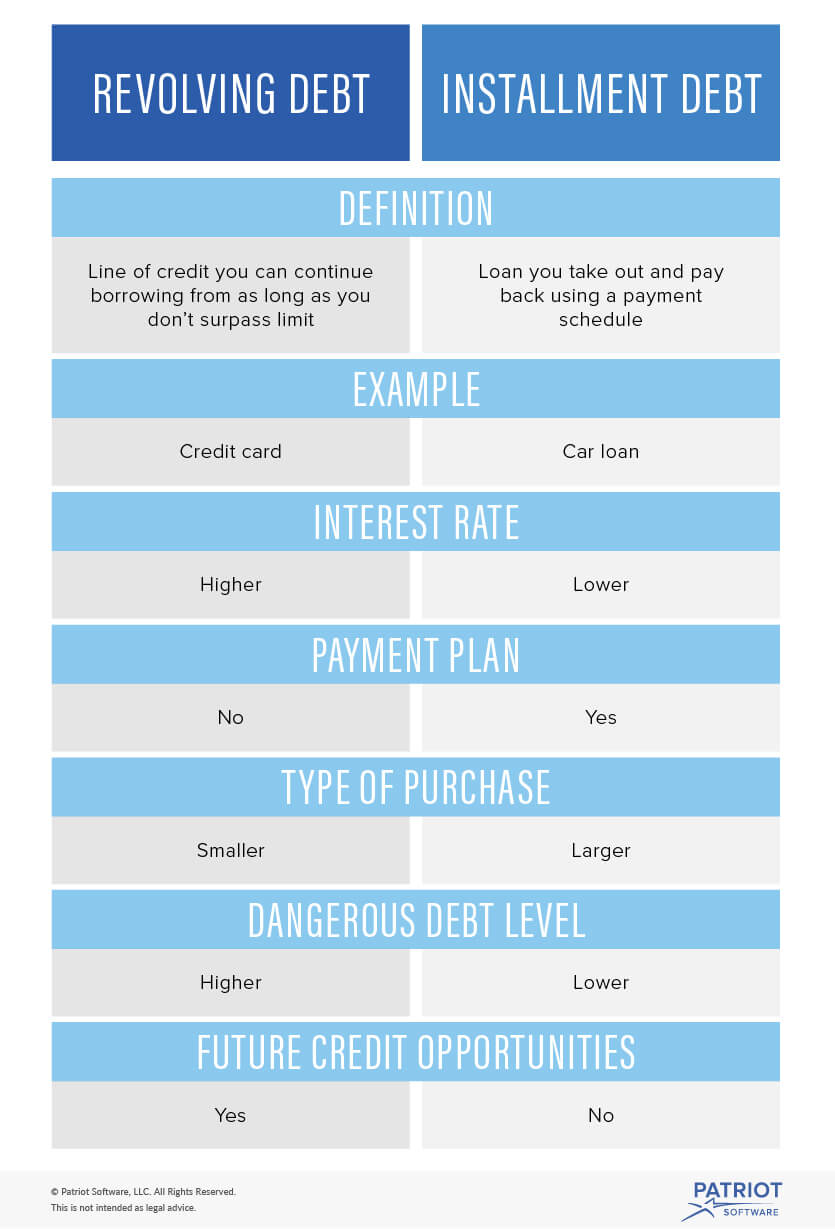

Revolving Debt Vs Installment Debt What S The Difference

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau